Loan principal is an amount that somebody has actually borrowed. This uses to all forms of financial obligation, whether it's a credit card balance, an auto loan, or a mortgage. If you obtain $3,000 to buy an automobile, for example, your initial loan principal is $3,000. The word "primary" implies "main." It is the primary part of the balance for loans, home loans, and investments.

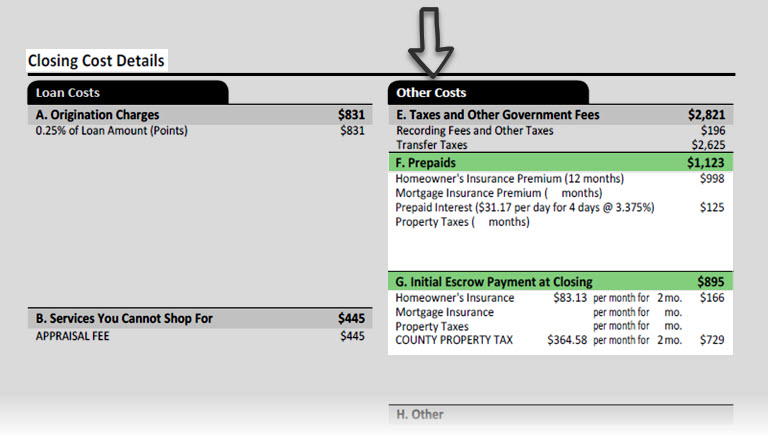

The financial obligation's general balance consists of the principal in addition to the interest that has accrued on that principal. The balance might likewise include costs and charges enforced by the lender, and a borrower's total month-to-month payment might include additional expenses such as insurance coverage or taxes. As a customer makes payments to the lender, they will reduce the principal, up until it is eventually removed entirely.

Consider this basic example. You take out a loan to buy some organization equipment, and the expense of the equipment is $10,000. You contribute $2,000 as a down marriott timeshare orlando payment as you open the loan, so the initialprincipal on the loan will be $8,000. The bank charges an annual rates of interest of 4%.

You make a monthly payment of $500. Of that payment, $27 pays off your interest balance, while the remaining $473 goes towards minimizing the principal. After making the payment, your loan principal is now $7,527. When computing the monthly payments, the bank amortizes the loan, spreading it out gradually.

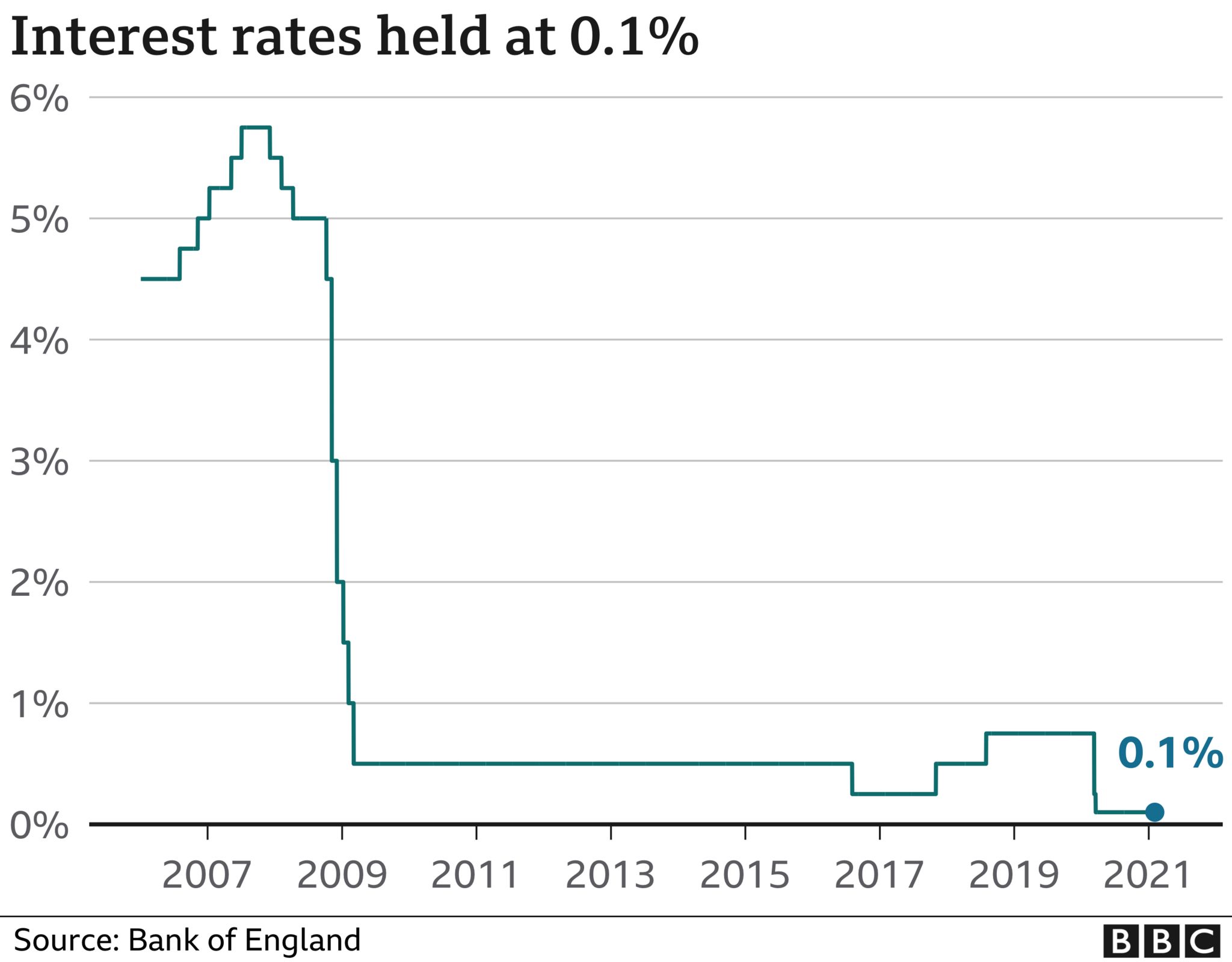

When a big loan is amortized, the bulk of your regular monthly payments will at first go more toward reducing interest rather than lowering the principal. That's due to the fact that you'll owe more interest when your principal is large (what is the concept of nvp and how does it apply to mortgages and loans). As your month-to-month payments chip away at the principal, the interest charges shrink, wyndham timeshare points chart and more of your monthly payments approach minimizing the principal.

If you want to compute the principal and interest payments on a loan yourself, U.S. government agencies offer online monetary calculators you can use, including calculators for typical debt situations such as trainee loans and mortgages. For Individuals. Individual taxpayers may be able to subtract the quantity they pay for loan interest each year, depending on the type of loan.

See This Report on How Do Reverse Mortgages Work When You Die

Payments toward your principal balance, nevertheless, are not tax-deductible. For Businesses. The primary quantity of a service loan is only part of the quantity you paid for business property (a business car or building, for example). The total quantity you paid (called cost basis) includes any deposit, costs to buy the possession, and other initial expenses.

Businesses can also cross out interest costs paid each year, with some restrictions. You might also hear the term primary described in the context of investments. As opposed to the quantity borrowed, an investor's principal is the amount of money they take into an investment. If the investment is a bond, the financier might get interest payments on the principal financial investment.

Most home mortgages and loans enable debtors to make extra payments to pay off the loan quicker. With a home mortgage, for instance, you can make principal-only and interest-only payments. A principal-only payment decreases the principal but not the interest. An interest-only loan payment pays for interest and does not reduce the principal.

Examine your home loan or loan file to make certain there is no pre-payment charge for paying off the loan prior to the anticipated reward date. The loan principal is the amount that has actually been obtained. miami timeshare cancellation Throughout the life time of the loan, the customer will pay that reduce the principal until it reaches $0.

A company might be able to diminish the principal quantity as part of the cost of a company asset and take a reduction on loan interest each year. People can't cross out the loan principal as the expense of a loan, however they might have the ability to compose off interest expense on a loan, with some constraints.

Are vehicle loan payments determined differently than home loan payments? Month-to-month payments for some vehicle loans may not be determined the exact same method a mortgage is. For home mortgages, the process of amortization is essentially a compounding approach. An excellent way to think about mortgage amortization is that you do not have one single loan, however rather specific loans with terms of 360 months, then one for 359 months, then one for 358 months and so on, all strung together.

Not known Facts About How Reverse Mortgages Work In Maryland

This is a process referred to as "amortization." To determine your monthly home loan payment over the life of your loan, make certain to have a look at our home loan calculator. On the other hand, installation loans-- like an auto loan-- can either be: "Easy interest add-on" or "Easy interest amortizing" These are in fact composed as a single loan; all of the interest that will be due is calculated up front, contributed to the overall of the loan as a financing charge, then that sum is divided over the variety of months in the term to get to your regular monthly payment.

These work like a home mortgage, with a decreasing loan balance and decreasing term producing a consistent monthly payment with altering structures of principal and interest. Prepaying these can save you some cash. There can also still be loans based upon a thing called the "Guideline of 78." These are easy interest add-on loans with a twist; they are structured to have you pay the interest due on the loan first, then as soon as that's done, your payments will cover the principal.

If you should hold the loan to term, there is no difference in overall cost when compared to a standard simple interest add-on loan, however if you need to require to pay the loan off early, you'll find that you'll still owe most-- if not all-- of the initial loan you took despite having actually made payments for some period of time.

or not. Examine your loan agreement for information; if it is a "simple interest add-on" type, do a Google look for "simple interest calculator" and you need to be able to find what you need. Print page.

When it's time to acquire a new car, the majority of people get an. This kind of loan is thought about a simple interest loan. This is the type of loan that Greater Texas Federal Credit Union offers. There are 3 components to a calculate basic interest loan: 1. Principal, or the quantity funded or borrowed 2.

Time, or your loan term Normally the term of your loan is composed at a fixed rate. This implies that your interest rate (APR) or the interest you pay, remains the very same throughout the regard to your loan. The finance charge you pay is based upon the number of days and the dollar amount that the unsettled balance is exceptional.

Some Known Questions About What Kind Of Mortgages Do I Need To Buy Rental Properties?.

And, what is leftover goes towards the principal. As you continue to make full and on-time payments every month, a higher portion of your loan payment will be used to the principal and less to interest every month till your. The interest is calculated versus your loan's outstanding principal or balance.